END OF YEAR BONUS: Spending your cash wisely

Par

Nafissah Fakun

Par

Nafissah Fakun

Par

Nafissah Fakun

Par

Nafissah Fakun

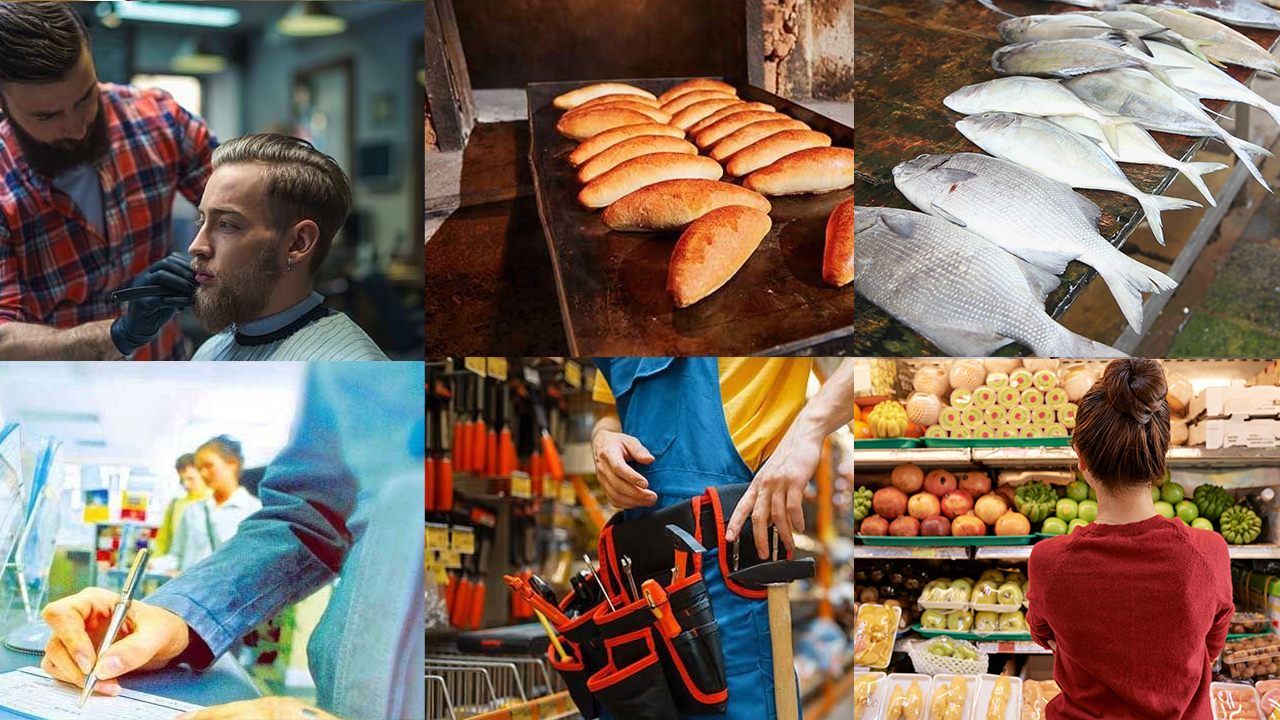

December is the month where households experience a financial boost with the end of year bonus. However, it is also the month where expenditures triple with the festivities, the gifts, school supplies and grocery shopping. But if you are not cautious by spending your bonus wisely, you may find yourself with an empty bank account or pocket come January. Here are some guidelines to follow.

It is very important to plan how to wisely use the end of year bonus. It is thus important to divide your bonus in various parts to have better control over your money. According to financial experts, the best way to split your bonus is as follows: 20% savings, 30% repayment of debts, 20% for your wants, and 30% for your investment. According to Jayen Chellum, secretary general of the Consumer Association of Mauritius (ACIM), people must wisely plan their expenditures according to their priorities. “People must bear in mind that there are additional expenditures for both January and December. Most of bonuses are often spent on gifts, food and clothing, leisure activities as well as school supplies for the beginning of academic year in January.”

Jayen Chellum trusts that the 325,000 workers who earn less than and up to Rs 15,000 per month should make a list of priorities in order to judiciously manage their expenditures. “End of year gifts have become a cultural thing. However, giving gifts must be more of a symbol of friendship and family ties rather than a matter of worth in terms of money,” explains the secretary general.

In terms of toys for kids, Jayen Chellum says that parents must ensure that they are appropriate for their age group. “If parents can buy gifts and toys that are appropriate for all their children to play with, then it is better as they can spend less on these. For example, a computer is a good idea as parents have to bear in mind that they will have upcoming major expenditures in terms of school supplies in January. A computer is also a good investment as it is an educative tool.”

Jayen Chellum also underlines that some people spend their bonuses in terms of home decoration and renovations. “This must done if it is really necessary, for example if they are damaged.” In terms of credit purchase during the festive period, he advises the public to make sure that they get warranty and insurance on their purchased item and to keep all receipts. He also advises the public to repay their debts with their bonuses. “Bonuses can also be used to pay the important bills such as water, electricity, telephone, and rent, among others.”

Scholar in Personal Development Ismael Essackjee endorses the philosophy of his mentor Jim Rohn for managing personal finances; which is to invest 30% of the income first and then spend what is left. “This prospect may appear daunting at first, but indeed one can live on 70% of one’s income if a decent financial plan is devised. This time-tested philosophy is described as: the first 10% should be invested on active capital like savings for purchase of property or assets. Other possibilities people can envisage is buying and selling for a profit; thus creating wealth. The next 10% should be invested on passive capital. The third 10% is for giving back to society.”

Giving starts the Receiving process, he explains. It is good to start early when the amount is small and develop the habit such that when the amount becomes bigger, the act of giving is easy. Finally, the remaining 70% will be spent on personal expenses like school stationeries for the kids, family get together, renewal of some household items and other necessities.

“Investment is vital if one wants to have a wealth plan that uses money to create money. This will create abundance leading to financial independence. Actually, the amount or percentage is not important and is only indicative and subjective; what is important is the philosophy and the discipline to be loyal to it. When you plant a seed, you do not reap the fruits after some days. Likewise, the results may not be noticeable in the first few weeks or months; but at the end of some years, the cumulative small investments will definitely create an enormous difference,” he says.

After a year of hard work, it is your right to have a little fun and relax during this festive season. You can pamper yourself with a day at a hotel, spa treatment or other entertainment. Websites like Marideal.mu or Deals.mu offer some of the best deals on hotel stays, activities and spa treatments. For instance, day packages can cost as from Rs 1,200 and above per adult depending on the facilities offered and the hotel category. You can also enjoy a sunny day with a day package at Ile aux Cerfs, including boat transfer and lunch, as from Rs 690 per adult.

Similarly, the spa packages vary according to the treatments. A full body massage can cost around Rs 800 or more. You can also pamper yourself with beauty treatments like facials, manicure and pedicure, nail polish application as from Rs 500. You can also remove your back pain that has accumulated due to work stress with a back massage as from Rs 900. If you want to have a fresh haircut or colour treatment and trendy highlights to look fab for the end of year festivities, it will cost you as from Rs 850 and above.

Regarding leisure, you can choose among a variety of activities for you and the kids. If you like the thrill of speed, 30 minutes of quad biking start as from Rs 713 per adult. The price varies depending on the minutes or hours. For a full day catamaran outing, the price will also depend on the package offered. For a catamaran cruise along the north coast of Mauritius, prices start as from Rs 1,199 per adult. The packages are more interesting if you are going in groups. For the kids, a fun day at, for example, Parc Loisirs Gros Cailloux, where they can enjoy various activities will cost as from Rs 238 (aged 3 to 12 years). For water activities such as speed boat, dolphin watch, scuba diving among others, prices start as from Rs 899.

Late night shopping, gift shopping, school supply shopping among others – much time is spent shopping during December. How to shop wisely in order not to exceed your budget? The first thing you must do is to make a list of your priorities. Also, why not give away some money to charity? Many plan their bonus expenses with the ‘To Buy’ list. Here’s how you can make your list and around how much will it cost you:

School Supply

School Supply

A sizeable portion of your bonus needs to go towards paying down any short-term debt that you may have. This debt may be in the form of credit cards, store cards or personal loans. These are the most expensive, and should therefore be paid off first. If you can, consider using your whole bonus to pay off this type of debt – it may be difficult, but just think how much extra you’ll save every month if you don’t have to pay off expensive debts.

Various banks offer saving plans. Many people do invest their money in savings when they receive their end of year bonuses. Among the various plans, you can find the education plans where customers contribute a monthly amount to plan for higher studies of his children, retirement plans where the customer can plan his retirement by contributing a monthly amount each month or savings account where the customer can also deposit his bonus in a savings account and will earn 2.75% per year.